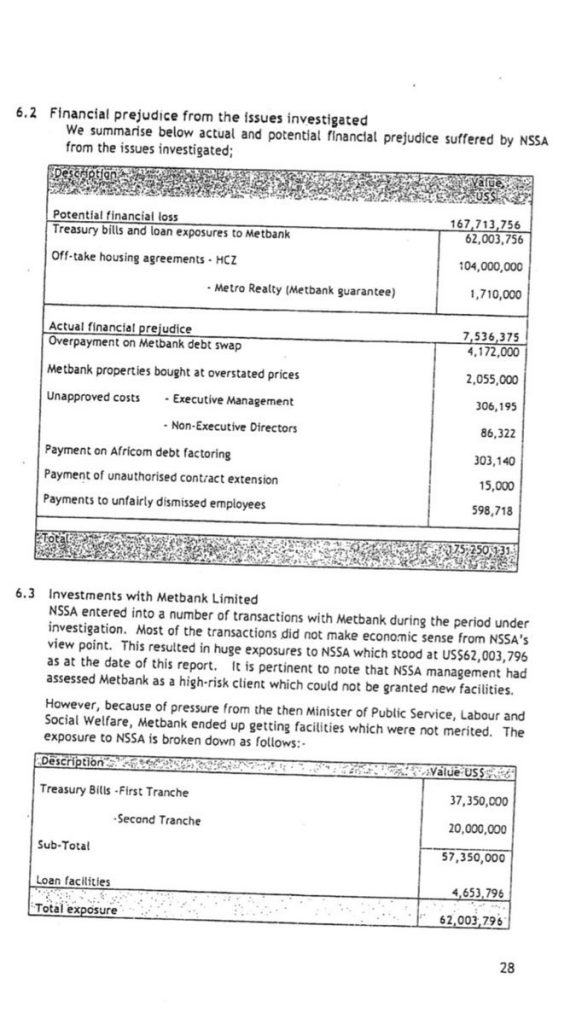

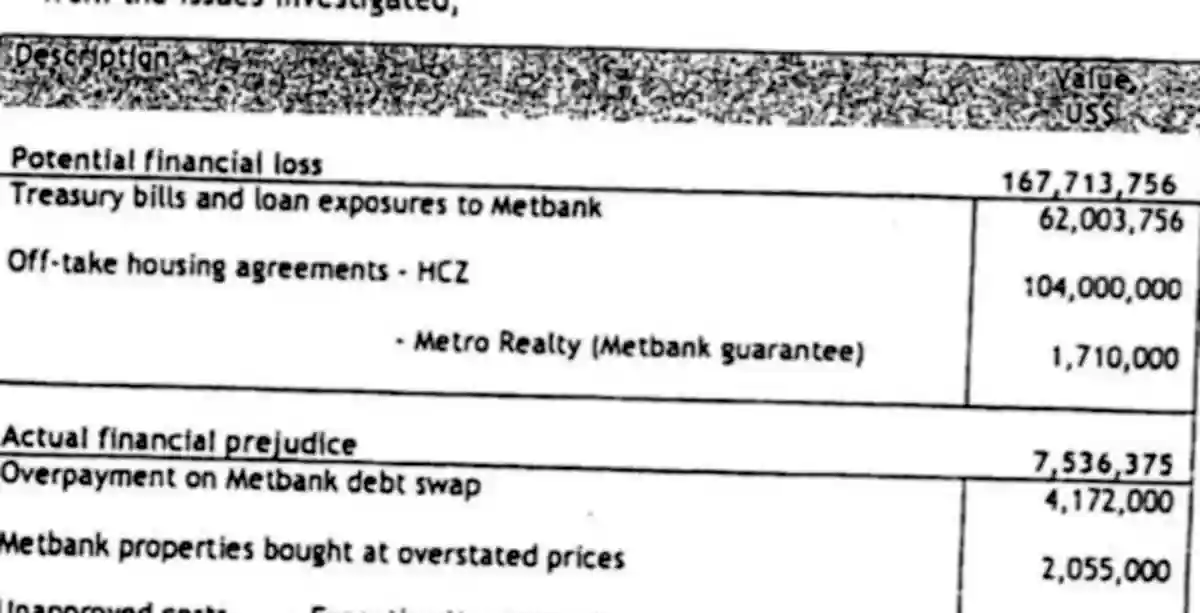

The forensic audit report released earlier this week has a breakdown of the money that NSSA potentially between January 2015 and February 2018 (the period covered by the Audit investigation).

According to the report, actualy significant amounts were lost to Metbank. Potential losses were also made to MetBank and housing agreements with an entity called HCZ.

The breakdown below:

| Description | Value ($US) |

|---|---|

| Potential Financial loss | |

| Treasury bills and loan exposure to MetBank | $62,003,756 |

| Off-take housing agreements - HCZ | $104,000,000 |

| Off-take housing agreements - Metro Realty (Metbank Guarantee) | $1,710,000 |

| Total Potential Financial loss | $167,713,756 |

| Actual Financial Prejudice | |

| Overpayment on Metbank Debt Swap | $4,172,000 |

| Metbank properties bought at overstated prices | $2,005,000 |

| Unapproved Costs - Executive Management | $306,195 |

| Unapproved Costs - Noon-Executive Directors | $86,322 |

| Payment on Africom debt factoring | $303,140 |

| Payment of unauthorised contract extension | $15,000 |

| Payments to unfairly dismissed employees | $598,718 |

| Total Actual Financial Prejudice | $7,536,375 |

| Grand Total | $175,250,131 |