FBC Backdating Collection Of 2% Tax On "Applicable Transactions"

The FBC Bank has announced that in line with the new Finance Act No.8 of 2020, the bank will be backdating collection of the 2% Intermediated Money Transfer Tax (IMTT) on all applicable Foreign Currency and ZWL transactions made from 01/08/2020. We present the bank’s statement in full below.

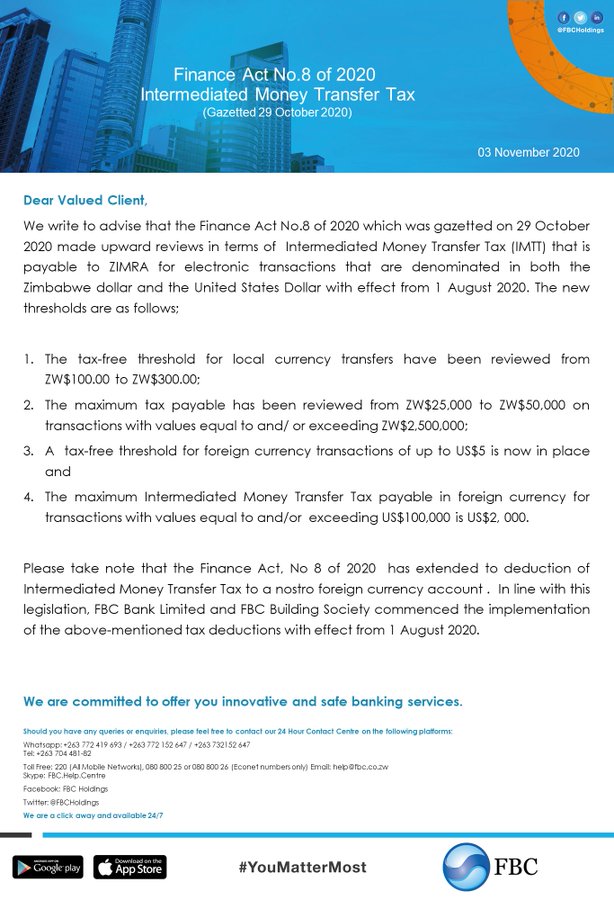

Dear Valued Client,

We write to advise that the Finance Act No.8 of 2020 which was gazetted on 29 October 2020 made upward reviews in terms of Intermediated Money Transfer Tax (IMTT) that is payable to ZIMRA for electronic transactions that are denominated in both the Zimbabwe dollar and the United States Dollar with effect from 1 August 2020. The new thresholds are as follows:

Feedback

- The tax-free threshold for local currency transfers hove been reviewed from ZW$100.00 to ZW$300.00:

- The maximum tox payable has been reviewed from ZW$25,000 to ZW$50.000 on transactions with valves equal to and/ or exceeding ZW$2,500,000;

- A tax-free threshold for foreign currency transactions of up to US$5 is now in place and

- The maximum Intermediated Money Transfer Tax payable in foreign currency for transactions with values equal to and/or exceeding US$100,000 is US$2, 000.

Please take note that the Finance Act. No 8 of 2020 has extended to deduction of Intermediated Money Transfer Tax to a nostro foreign currency account . In line with this legislation, FBC Bank Limited and FBC Building Society commenced the implementation of the above-mentioned tax deductions with effect from I August 2020.

Tags

0 Comments

Leave a Comment

Generate a Whatsapp MessageBuy Phones on Credit.

More Deals