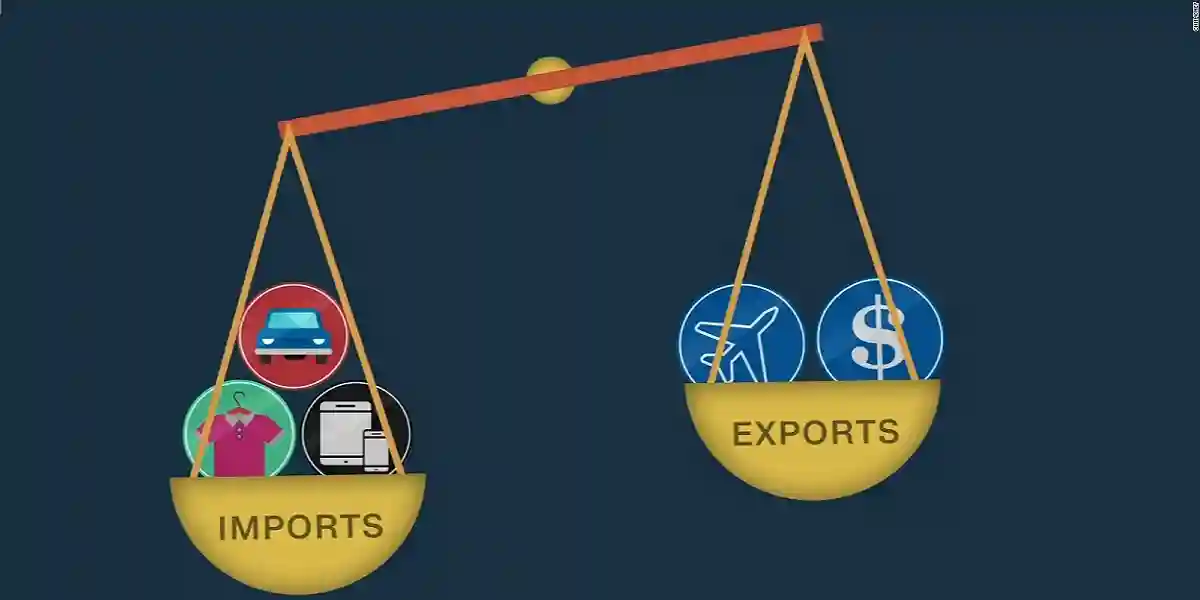

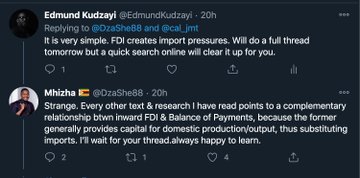

Former Sunday Mail editor, Edmund Kudzayi has claimed that a trade deficit is not necessarily a bad thing. A trade deficit is an amount by which the cost of a country’s imports exceeds its exports. It’s one way of measuring international trade, and it’s also called a negative balance of trade. Below is Kudzayi’s Twitter thread on the matter.

Yesterday, responding to a Bloomberg article which claimed that Zimbabwe’s ‘trade surplus’ is evidence of progress, I pointed out that a trade deficit is not necessarily a bad thing. Indeed, it is not.

More: Edmund Kudzayi