The government of Zimbabwe has announced a plan to borrow ZW$146.8 billion (about US$1.4 billion) in 2022 to fund various infrastructure development projects.

This debt would add to the existing stock of US$13.7 billion, according to a paper on debt trends released Thursday.

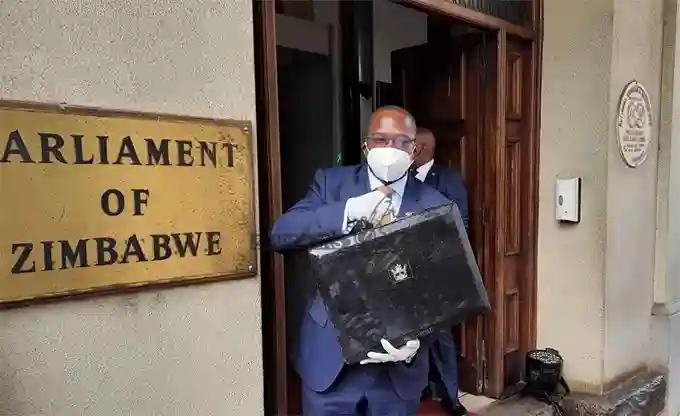

Finance minister Mthuli Ncube said the debt will be sourced through the issuance of government securities, utilisation of the International Monetary Fund Special Drawing Rights (SDRs) allocation and external loan disbursements.

The IMF SDRs were received in August as part of a big global package announced to stabilise the global economy in the aftermath of the COVID-19 pandemic.

The statement on public debt was presented to Parliament Thursday along with the 2022 national budget. Ncube said:

On domestic borrowing, government will continue to issue Treasury Bills through the auction system for competitive pricing, as well as to improve accountability and transparency. The projected stable macroeconomic environment, characterised by low stable inflation, as well as, stable exchange rate is expected to spur the uptake of medium to long-term government securities by investors.

As part of deficit financing, the government will issue seven-year USD denominated Treasury bonds of up to US$100 million, to be listed on the Victoria Falls Securities Exchange (VFEX) during the first quarter of 2022, earmarked for specific priority infrastructure projects.

Government borrowing has in the past attracted criticism from stakeholders including the Zimbabwe Coalition on Debt and Development (ZIMCODD).

ZIMCODD argues that the huge chunk of the country’s debt is due to corruption which goes unpunished.

More: The Independent