Reserve Bank of Zimbabwe Governor, John Mangudya, has said it is suicidal to act to narrow a widening gap between the national currency’s official and black market rates.

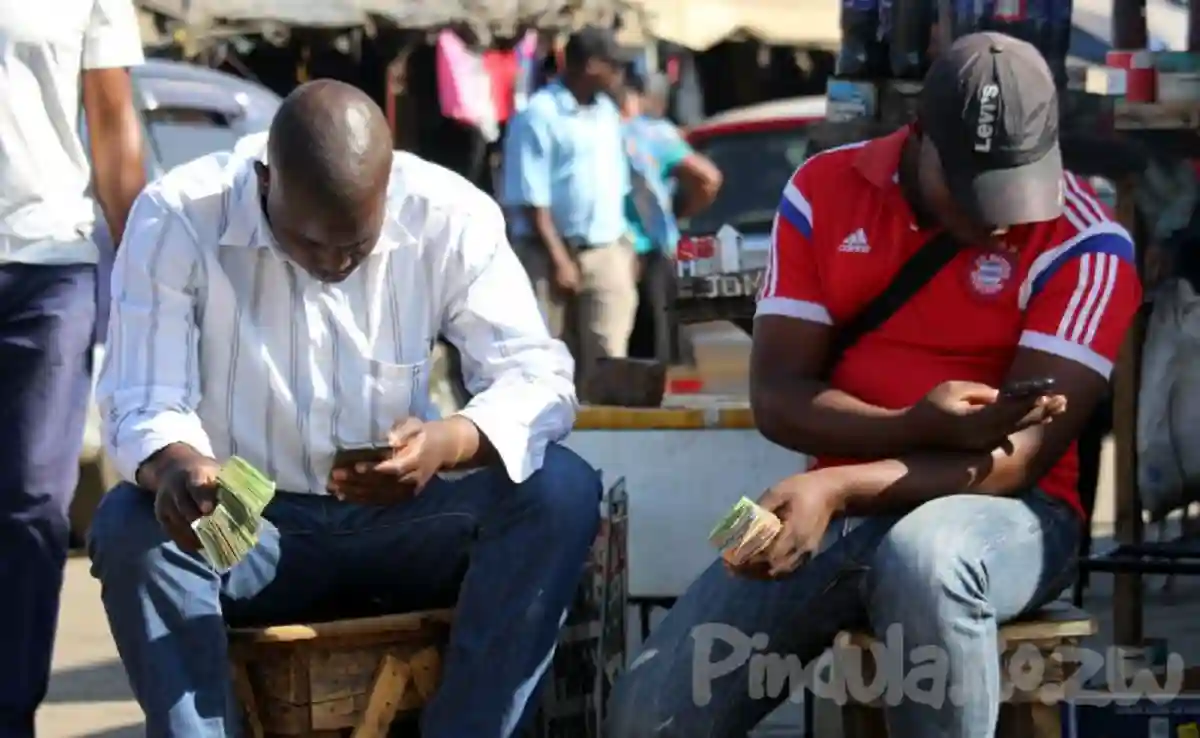

While the Zimbabwe dollar traded at 112.8228 to a United States dollar at the foreign currency auction conducted by the central bank this Tuesday while it trades at over 200 to the dollar on the black market. He said on Monday:

We would love convergence, but it requires the business community to also walk the talk. Convergence must be at a realistic exchange rate.

The unofficial rate will only surge even higher, decimate the earnings of citizens and lead to price hikes in the southern African nation, where annual inflation was 61% in December.

People just want to hold US dollars.

Business leaders have blamed the disparity on a lack of foreign currency supply though Mangudya says it’s due to many businesses accepting payment in US dollars at the unofficial, or parallel market, rate.

Meanwhile, analysts say the delay in resuming the weekly foreign currency auction only helped in promoting the parallel market as a source of US dollars.

The business community says it is struggling to obtain the foreign currency which it needs to keep operations running and is forced to turn to the parallel market.

More: NewZimbabwe