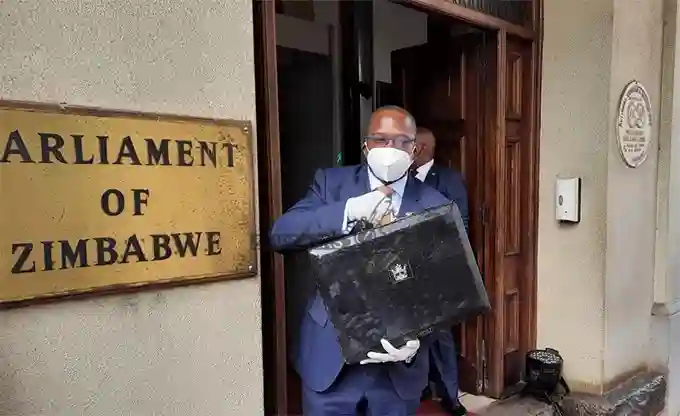

The Finance and Economic Development Minister of Zimbabwe, Professor Mthuli Ncube, has announced additional measures to stabilize the country’s economy and the depreciating Zimbabwe dollar.

In a statement seen by Pindula News, Ncube said the additional measures include increasing the retention of domestic foreign currency sales to 100%, lifting all restrictions on the importation of basic goods, promoting the use of domestic currency, and introducing a system to manage the traceability of gold.

Ncube added that the government will also assume all foreign currency debts from the Reserve Bank of Zimbabwe, create a debt redemption fund, and tighten monetary policy to reduce bank lending and money creation.

Additionally, the government will continue to review civil servant salaries and allowances in line with these developments and policy measures. He added that the government remains committed to maintaining macroeconomic stability, preserving the purchasing power of the Zimbabwe dollar, and restoring trust and confidence in the economy. We present the statement below:

STATEMENT ON POLICY MEASURES TO STABILISE THE ECONOMY

Introduction

1. Under the National Development Strategy 1, Government has made considerable progress in fostering domestic macroeconomic stability by implementing a broad range of fiscal and monetary stabilisation measures.

2. In order to continue on the macroeconomic stabilisation front, Government on the 21 of May 2023, introduced the following additional measures to curb the further depreciation of the local currency and increases in prices marked in domestic currency:

• Increasing the retention on domestic foreign currency sales to 100%- This has resulted in domestic businesses accessing more foreign currency from the market and this potentially translating into additional US dollar deposits in the banking system;

• Adoption of all external loans by Treasury- This process is well under way and will result in all external liabilities being funded transparently through the National Budget;

• Increasing Consumers’ Access to Basic Commodities- Lifting all restrictions on importation of basic goods which has promoted competition thereby resulting in a reduction in prices; and

• Promotion of use of domestic currency by Government Agencies which is expected to further increase the demand for the local currency.

Following on the decision for adoption by Treasury, conferring full responsibility on it, of repaying all foreign currency denominated loans contracted through the Reserve Bank of Zimbabwe, Government announces supportive measures as follows:

Government will implement the following measures as from 01 June 2023:

• Treasury will now fund the Zimbabwe Dollar component of the 25% foreign currency surrendered by exporters, in order to eliminate the creation of additional money supply. The foreign currency collected from the 25% that is surrendered, will now be collected by Treasury and utilised in servicing the foreign currency loans assumed from the Reserve Bank of Zimbabwe. Banks will no longer withhold any foreign currency surrendered by exporters, and all the liabilities to the banks will be settled through Treasury.

• Introduce a 1% tax on all foreign payments.

• Maintain the USD Cash withdrawal tax at 2%.

• Through Fidelity Gold Refinery, introduce a system to manage traceability of gold from its origin, both commercial and small scale, in line with international standards.

• All excise duty on fuel will now be paid for in foreign currency.

3. In order to encourage banking of foreign currency, which is mainly in the informal sector, while promoting use of the local currency Government will:

• Reduce the local interbank foreign transactions IMT tax to 1% ;

• Reduce the POS IMT tax in foreign currency to 1%;

• Promotion of use of the domestic currency:

i. All Government Agencies including Parastatals will substantially now collect their fees in local currency;

ii. Payments to ZESA by non-exporters will be made in the local currency; and

ii. All Customs Duty to be payable in local currency, with the exception of designated or luxury goods. and where the importer opts to pay in foreign currency.

4. Treasury will assume all foreign currency debts from the Reserve Bank of Zimbabwe on 01 June 2023.

5. Government shall create a debt redemption fund to service other external liabilities in line with the arrears clearance program. These will be funded through new levies and other resource mobilisation initiatives.

Other Supportive Policy Measures for Immediate Implementation

6. The above will be supported by the following policy measures:

• All export proceeds that remain unutilised after 90 days will be liquidated onto the interbank market.

• The weekly auction will be limited to a maximum of US$5 million. • As from 1 June 2023, winning bids at the auction will be paid within 24 hours of award.

• All public foreign currency debts will be contracted by Government and will be the responsibility of Treasury.

• There will be tightening of monetary policy in order to reduce lending and hence money creation by banks.

• All manufacturers selling general goods, such as cement, milk, soft drinks, etc for the export market, will now be required to charge VAT, which is refundable by ZIMRA after exporting.

7. Government will continue to sterilise excess liquidity already injected into the economy through issuance of Treasury bills, whilst the Reserve Bank will also continue to sterilise through appropriate monetary policy tools.

8. With regards to externalisation of funds and transfer pricing, Government will strengthen surveillance and monitoring, complemented by a robust foreign currency payment system and information sharing system between financial institutions and ZIMRA.

9. Government will continue to review Civil Servants salaries and allowances in line with the above developments and policy measures, including increasing the threshold of the local currency IMT tax.

Conclusion

The assumption of the external obligations by Treasury and implementation of non-inflationary financing of the liabilities, coupled by sourcing of additional resources. will go a long way in reducing money supply growth and its impact on exchange rate depreciation and price increases.

Government remains firmly committed to the maintenance of macro-economic stability, the preservation of the purchasing power of the Zimbabwe dollar and the restoration of trust and confidence in the economy.