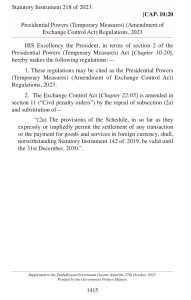

The Zimbabwean government has allowed for the settlement of transactions and payment for goods and services in foreign currency until 31 December 2030. President Emmerson Mnangagwa said Statutory Instrument 218 of 2023 overrides another regulation called Statutory Instrument 142 of 2019 which declared the Zimbabwe Dollar as the sole legal tender in any transaction in Zimbabwe.

There has been confusion regarding the termination of the multicurrency regime in Zimbabwe. The government initially stated that it would end in 2025, but this caused uncertainty. Although the Minister of Finance, Professor Mthuli Ncube, assured that the regime would continue beyond 2025, the business sector remained doubtful.

Recently, banks stopped providing loans in United States Dollars (USD) due to concerns about what happened in 2019. During that time, USD bank balances were converted to Zimbabwean dollars with authorities claiming they had the same value as the USD. However, the Zimbabwean dollar later lost its value, leading to significant losses for depositors. As a result, people have lost confidence in the banking system, leading to a decline in bank deposits.

Inconsistent monetary and fiscal policies have made foreign investors hesitant to invest. They are concerned that they won’t be able to take their profits back to their home countries or that their profits will be reduced by high inflation. Monetary and fiscal policies can influence foreign direct investment by affecting interest rates, and exchange rates, and providing incentives. Stable economic conditions and reliable policies are important for attracting foreign investors.