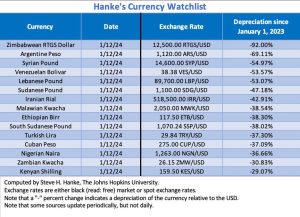

American economist Professor Steve Hanke has declared Zimbabwe’s currency as the weakest in the world adding that the southern African nation has the highest inflation rate globally. According to Hanke’s currency watchlist, on January 12, 2024, the Zimbabwe dollar traded at ZWL$12,500 per US$1 and had lost 92% of its value since January 1, 2023.

- Zimbabwe Experienced A Sharp Increase In Food Inflation In December

- Zimbabwe’s Month-on-month Inflation Jumps To 4.5% In November

- Economist Mugano Calls For Frank Discussion On Zimbabwe’s Inflation, Exchange Rate, Currency

Journalist Hopewell Chin’ono responded to Hanke’s report, stating that it vindicates his previous statements about the poor state of the Zimbabwean currency. Chin’ono argued that Zimbabwe has become the riskiest place to invest in Africa, with an unemployment rate of 95%. He emphasised that the significant depreciation of the Zimbabwean dollar is an undeniable economic fact, reflecting the country’s overall economic performance.

Chin’ono attributed the economic challenges to corruption, incompetence, inconsistent policies, lack of the rule of law, misuse of state institutions, and failure to attract investment. Consequently, Zimbabweans have lost trust in the government, leading them to bank their savings in other countries or keep them hidden to protect against institutional corruption. He said:

The Zimbabwean dollar lost 92% of its buying power in the last 12 months making it the weakest currency in the world, this is not an opinion, this is an economic fact backed up by data. A currency is a direct reflection of how a country’s economy is performing, as the Ghanaian Vice-President Dr Mahamudu Bawumia famously said; “…when in doubt (of how the economy is performing), check the currency.” We can’t run away from the fact that economic indicators such as inflation rates and currency strength or weakness are critical reflections of a country’s economic performance. So naturally the economic challenges faced by Zimbabwe as reflected in the weakening currency and high inflation indicate deep underlying economic issues…

This explains why Zimbabweans mostly bank their savings in South Africa and those who can in Europe and America, they have correctly lost trust in the Government. Those who can’t travel bank it under the pillow to avoid losing it to institutional corruption. Our country is now in the top ten worst governed countries, it is also now officially the riskiest country to invest in Africa according to global risk assessment economic organisations, even riskier than African countries at war. The average Zimbabwean doesn’t keep their hard currency in the bank for fear of losing it simply because the trust between the governing authorities and the citizens broke down after two cycles of citizens losing their savings and pensions in Zimbabwean banks due to corrupt government policies.

In addition to economic challenges, Zimbabwe struggles with issues such as cholera outbreaks, inadequate healthcare facilities, and the imprisonment of critics and political opponents. Chin’ono highlights the government’s tendency to deflect blame onto external factors like sanctions while ignoring internal issues such as the smuggling of gold by ZANU PF elites and their associates. He says Zimbabwe has transformed into a “mafia state” and unless fundamental changes occur, economic recovery will remain elusive.

The Zimbabwe dollar has a turbulent history. It replaced the Rhodesian dollar when Zimbabwe gained independence in 1980. Initially, it had a similar value to the US dollar. However, economic problems led to excessive money printing and high inflation. In 2008, hyperinflation hit, making the Zimbabwe dollar almost worthless. To stabilise the economy, then-Finance Minister Patrick Chinamasa introduced the multi-currency regime in 2009. However, in June 2019, the Zimbabwe dollar returned as the main currency. The government stated that it was equivalent to the United States dollar. Yet, it faced ongoing challenges, with high inflation and loss of value. Today, it’s considered the weakest currency globally, struggling to regain stability and trust.