Trustworth Quality Bales 👚👖👗👕

Basa redu tinohodhesa mabhero, mabhero emhando yepamusoro nemutengo wakanaka. We have a good reputation and customer yatatanga kudealer nayo todealer in the long run because of customer loyalty. +263783405393

OpenRBZ Exchange Control Circular No. 3 Of 2024 To Authorised Dealers | Full Text

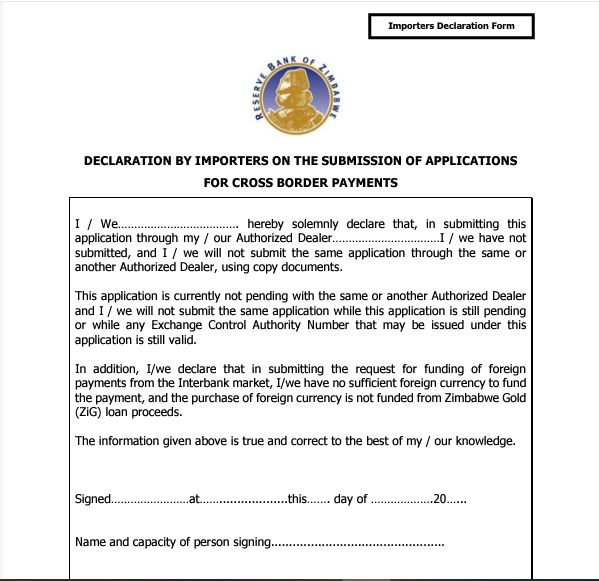

EXCHANGE CONTROL CIRCULAR NO. 3 OF 2024 TO AUTHORISED DEALERS

ISSUED IN TERMS OF SECTION 35 (1) OF THE EXCHANGE CONTROL REGULATIONS STATUTORY INSTRUMENT 109 OF 1996

1. Reference is made to Exchange Control Directive RZ56 of 08 April 2024 and Exchange Control Circular No. 1 of 03 May 2024, wherein Authorised Dealers were advised of the Interbank Foreign Exchange Guidelines. Exchange Control further advises as follows: –

Duplication of Invoices through Different Authorised Dealers

2. Whilst the Bank recognizes that most companies are multi-banked, Authorised Dealers are advised that for the pipeline demand, applicants are limited in submitting invoices to not more than two (2) banks. This refers to invoices of the same goods from the same supplier without duplicating the same invoice.

3. In this regard, Authorised Dealers should ensure that their clients make appropriate declarations to indicate non-submission of the same invoice through a different Authorised Dealer. This should be done through completion of the Importers Declaration Form (attached) prior to the inclusion of the request on the pipeline demand.

4. In addition, market participants are encouraged to effectively and efficiently utilize foreign exchange in the management and importation of stocks to avoid speculative stockpiling. Exchange Control will, from time to time, conduct regular checks on this issue.

Utilisation of Loan Proceeds to Participate on the Interbank Market

5. As previously communicated under Exchange Control Directive RZ56 dated 08 April 2024, market participants are not permitted to participate on the interbank foreign exchange market using proceeds from local borrowings.

6. Accordingly, market participants shall be required to declare on the Importers Declaration Form that the ZiG balances are not from borrowings prior to inclusion of the request on the pipeline demand.

Importers with Sufficient FCA Balances

7. Authorised Dealers are advised that FCA holders with sufficient balances in their accounts across all banks, should first utilize their foreign exchange for foreign payments before accessing funds from the Interbank Foreign Exchange Market or the pipeline demand.

8. In this regard, companies intending to fund payments from the interbank market shall sign the Importers Declaration Form that they do not have sufficient balances.

Exchange Control Compliance

9. Authorized Dealers are directed to ensure adherence to all the Exchange Control compliance parameters contained in this Circular by all market participants when administering transactions on the Interbank Foreign Exchange Market and the pipeline demand.

10. Market participants found in violation of Exchange Control rules and regulations shall be penalized and/or barred from participating on the Interbank market in accordance with Section 5(1) of the Exchange Control Act [Chapter 22:05] and Section 37 (i), (ii), (iii) of Exchange Control Regulations, Statutory Instrument 109 of 1996.

Please be guided accordingly.

F. Masendu

Director EXCHANGE CONTROL

02 September 2024

More: Pindula News

Tags